Exploring the Best Real Estate Markets Near Southern California Colleges

When you’re thinking about investing in real estate near colleges in Southern California, you want to know where the hot spots are. These areas not only attract students but also promise great returns on your investment. Let’s dive into the top-performing real estate markets around colleges in this vibrant region.

1. Coastal Charms: Huntington Beach and Pepperdine University

Imagine owning a property just a short drive from the sandy shores of Huntington Beach, with Pepperdine University nearby. This area isn’t just about surf and sun; it’s a magnet for students seeking a coastal lifestyle. Properties here tend to hold their value well, making it a stable choice for investors looking for long-term gains.

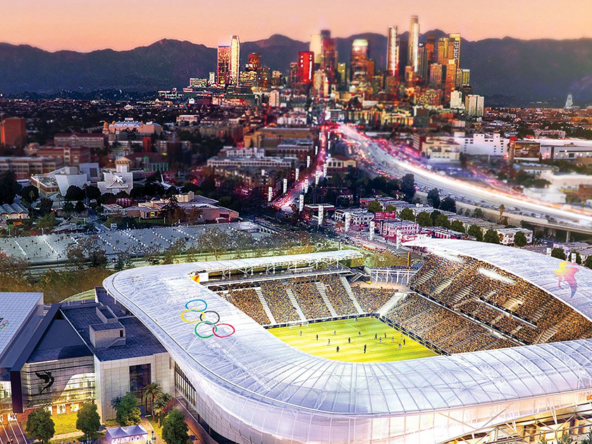

2. Urban Vibes: Downtown Los Angeles and USC

If city living is more your style, consider Downtown Los Angeles, home to the prestigious University of Southern California (USC). The downtown area has seen significant revitalization, attracting not only students but also young professionals. Investing here means tapping into a dynamic rental market fueled by the proximity to major employers and cultural hotspots.

3. Academic Excellence: Claremont and the Claremont Colleges

Nestled in the picturesque city of Claremont lies a consortium of seven renowned colleges, collectively known as the Claremont Colleges. This area boasts a stable and affluent tenant base of students and faculty members. Properties here often appeal to families looking for quality education, ensuring consistent demand and competitive rental incomes.

When you’re considering where to invest, think about what appeals to potential tenants – whether it’s proximity to the beach, the allure of city life, or the academic prestige of renowned colleges. Each of these factors can influence the desirability and profitability of your investment property in Southern California.

4. Emerging Hotspots: Riverside and UC Riverside

Looking for an up-and-coming area with great potential? Riverside, home to the University of California, Riverside (UCR), is becoming increasingly popular among students and investors alike. The city offers a more affordable housing market compared to coastal regions while still providing easy access to major employment centers in Southern California.

As you explore these top-performing real estate markets near colleges in Southern California, remember to consider not just the current market conditions but also the long-term trends. Investing in areas with growing student populations, strong rental demand, and infrastructure development can set you up for success in the dynamic Southern California real estate market.

Unveiling Rental Yields and Property Appreciation Near SoCal Colleges

Curious about how investing near colleges in Southern California can pay off? Let’s break down the numbers and see why these properties are a smart choice for savvy investors like you.

Understanding Rental Yields: Where the Money Comes In

When you invest in real estate near colleges, you’re tapping into a steady stream of potential tenants. Students, faculty, and staff often seek housing close to campus, creating a robust rental market. This demand translates into consistent rental income for you, ensuring your investment keeps generating cash flow year-round.

Consider this: properties near colleges tend to have higher occupancy rates, meaning fewer vacancies and more money in your pocket. Plus, rental yields can be attractive, especially in areas with limited housing options or high student enrollment. It’s all about finding the sweet spot where demand meets profitability.

Calculating Property Appreciation: Watching Your Investment Grow

One of the perks of investing near colleges is the potential for property appreciation. As surrounding neighborhoods develop and student populations grow, property values tend to rise over time. This appreciation can significantly boost your investment’s overall return, turning a modest initial investment into a valuable asset.

Think of it this way: buying a property near a college isn’t just about the rental income today but also about the value it could accrue in the future. As the area becomes more desirable and amenities improve, your investment becomes more valuable too.

Case Studies and Success Stories: Real-Life Examples of Profitable Investments

Let’s dive into some real-life examples to illustrate the potential of investing near colleges in Southern California. Take, for instance, a property near UCLA. Over the past decade, properties in Westwood have seen steady appreciation due to UCLA’s prestigious reputation and the area’s amenities.

Similarly, in Irvine near UC Irvine, investors have benefited from the city’s planned development and the university’s expanding student population. These success stories highlight how strategic investments in the right location can lead to both rental income and long-term capital gains.

As you consider your own investment strategy, think about the unique factors of each college town. Research local demographics, rental trends, and development plans to gauge where the next opportunity lies. Remember, each property is not just a place to live but also a potential source of financial growth.

Tips for Maximizing Your Investment Potential

Now that you understand the basics of rental yields and property appreciation near Southern California colleges, let’s explore some tips to maximize your investment potential:

- Location Matters: Choose properties close to campus and amenities like public transportation and shopping centers to attract tenants.

- Know Your Numbers: Calculate potential rental income versus expenses like property taxes, maintenance, and mortgage payments to ensure positive cash flow.

- Stay Informed: Keep an eye on local market trends, student enrollment numbers, and development projects that could impact property values.

By staying informed and making smart decisions, you can leverage the steady demand and growth potential of real estate near colleges in Southern California. Whether you’re aiming for immediate rental income or long-term appreciation, investing in these vibrant communities can be a rewarding venture for years to come.

Exploring Successful Investments by Taiwanese Investors Near SoCal Colleges

Ever wondered how Taiwanese investors are making waves in Southern California’s real estate market near colleges? Let’s take a peek at some inspiring case studies that show just how lucrative these investments can be.

1. The UCLA Connection: A Tale of Westwood Success

Imagine owning a cozy apartment near UCLA in Westwood. Taiwanese investors seized this opportunity years ago, banking on UCLA’s renowned status and the area’s affluent demographic. With consistent student demand and proximity to upscale amenities, these investors have seen impressive rental yields and steady property appreciation.

For instance, one investor purchased a condo in Westwood Village, renting it out to UCLA students. With careful management and strategic upgrades, the property’s value has steadily risen, showcasing the potential for long-term gains in this prestigious neighborhood.

2. UC Irvine: From Investment to Innovation

Moving south to Irvine, Taiwanese investors have capitalized on the city’s planned development and the growing influence of UC Irvine. One investor, Mr. Chen, purchased a townhouse near the university, foreseeing the influx of students and faculty seeking quality housing. His foresight paid off as rental income flowed in consistently, supported by Irvine’s reputation for safety and educational excellence.

Mr. Chen’s story illustrates how understanding local dynamics and investing in growing communities can lead to both financial stability and appreciation. By focusing on areas with strong rental demand and favorable economic indicators, Taiwanese investors like him are setting benchmarks for success in Southern California’s competitive real estate landscape.

3. Riverside: Rising Investments Alongside UC Riverside

Venturing into Riverside, Taiwanese investors have tapped into the city’s affordable housing market near UC Riverside. Ms. Lin, another investor, purchased a duplex near campus, targeting the area’s increasing student population. Through diligent property management and community engagement, Ms. Lin has achieved high occupancy rates and steady rental income.

Her experience highlights the importance of market research and strategic planning when investing near colleges. By identifying emerging opportunities and adapting to local demands, Taiwanese investors can thrive in diverse markets like Riverside, where affordability and growth potential converge.

Tips for Aspiring Taiwanese Investors

Now that you’ve glimpsed into these success stories, here are some tips if you’re considering investing near Southern California colleges:

- Research Thoroughly: Understand the local real estate market, including rental trends, vacancy rates, and future development plans.

- Build a Network: Establish connections with local real estate agents, property managers, and community stakeholders to stay informed and build trust.

- Diversify Your Portfolio: Consider investing in different college towns to spread risk and capitalize on varied market dynamics.

By following these tips and learning from successful case studies, you can navigate the nuances of investing near colleges in Southern California effectively. Whether you’re aiming for rental income, property appreciation, or both, Taiwanese investors demonstrate that strategic investments and foresight can lead to prosperous outcomes in this competitive market.